The challenge facing modern fintech companies in Saudi Arabia extends far beyond simple user verification. Traditional Know Your Customer (KYC) processes, while necessary for regulatory compliance, have become significant barriers to user adoption and business growth. The conventional approach requires multiple document uploads, manual verification steps, and lengthy waiting periods that can extend customer onboarding from minutes to days or even weeks.

Our case study focuses on a leading Saudi fintech company that recognized the urgent need to transform their customer onboarding process without compromising security or regulatory compliance. The company, which provides digital payment solutions and financial services to both consumers and businesses, was experiencing significant customer drop-off during the registration process. Initial analysis revealed that over 60% of potential customers abandoned their registration attempts before completion, primarily due to the complexity and time requirements of the traditional KYC process.

The existing onboarding process required customers to provide multiple forms of identification, including national ID cards, bank statements, and proof of address documents. Each document required manual review by compliance officers, creating bottlenecks that could delay account activation for several business days. The process was particularly challenging for younger users and those in remote areas who expected immediate digital experiences similar to those provided by global technology platforms.

The solution implemented by this forward-thinking fintech company centered on intelligent authentication that leveraged multiple verification methods while maintaining the highest security standards. The new system integrated seamlessly with Saudi Arabia's National Digital Identity platform (Nafath), enabling instant identity verification for Saudi nationals. This integration alone eliminated the need for manual document review in over 80% of cases, dramatically reducing processing time and improving user experience.

The intelligent authentication system employed risk-based assessment algorithms that could evaluate user behavior, device characteristics, and transaction patterns in real-time. Low-risk users with strong digital identity verification could complete onboarding in under three minutes, while higher-risk cases were automatically flagged for additional verification steps. This approach ensured that security standards were maintained while providing a smooth experience for the majority of legitimate users.

Biometric verification played a crucial role in the new onboarding process. The system utilized facial recognition technology to match users with their official identification documents, providing an additional layer of security while maintaining user convenience. The biometric verification process was designed to work seamlessly across different device types and lighting conditions, ensuring accessibility for all users regardless of their technical setup.

Multi-channel OTP delivery was implemented to accommodate diverse user preferences and ensure reliable verification across different communication methods. Users could receive verification codes via SMS, WhatsApp, email, or voice calls, with the system automatically selecting the most appropriate channel based on user preferences and delivery success rates. This approach significantly reduced verification failures and improved the overall completion rate of the onboarding process.

The implementation process required careful coordination between multiple stakeholders, including technology teams, compliance officers, and regulatory authorities. The company worked closely with the Saudi Arabian Monetary Authority (SAMA) to ensure that the new authentication methods met all regulatory requirements while providing enhanced security compared to traditional approaches. Regular audits and compliance reviews were established to maintain ongoing adherence to evolving regulatory standards.

Training and change management were critical components of the successful implementation. Customer service teams were trained on the new authentication methods to provide support when needed, while compliance teams were educated on the enhanced security features and audit capabilities of the intelligent authentication system. Clear communication with customers about the improved process helped build confidence and trust in the new approach.

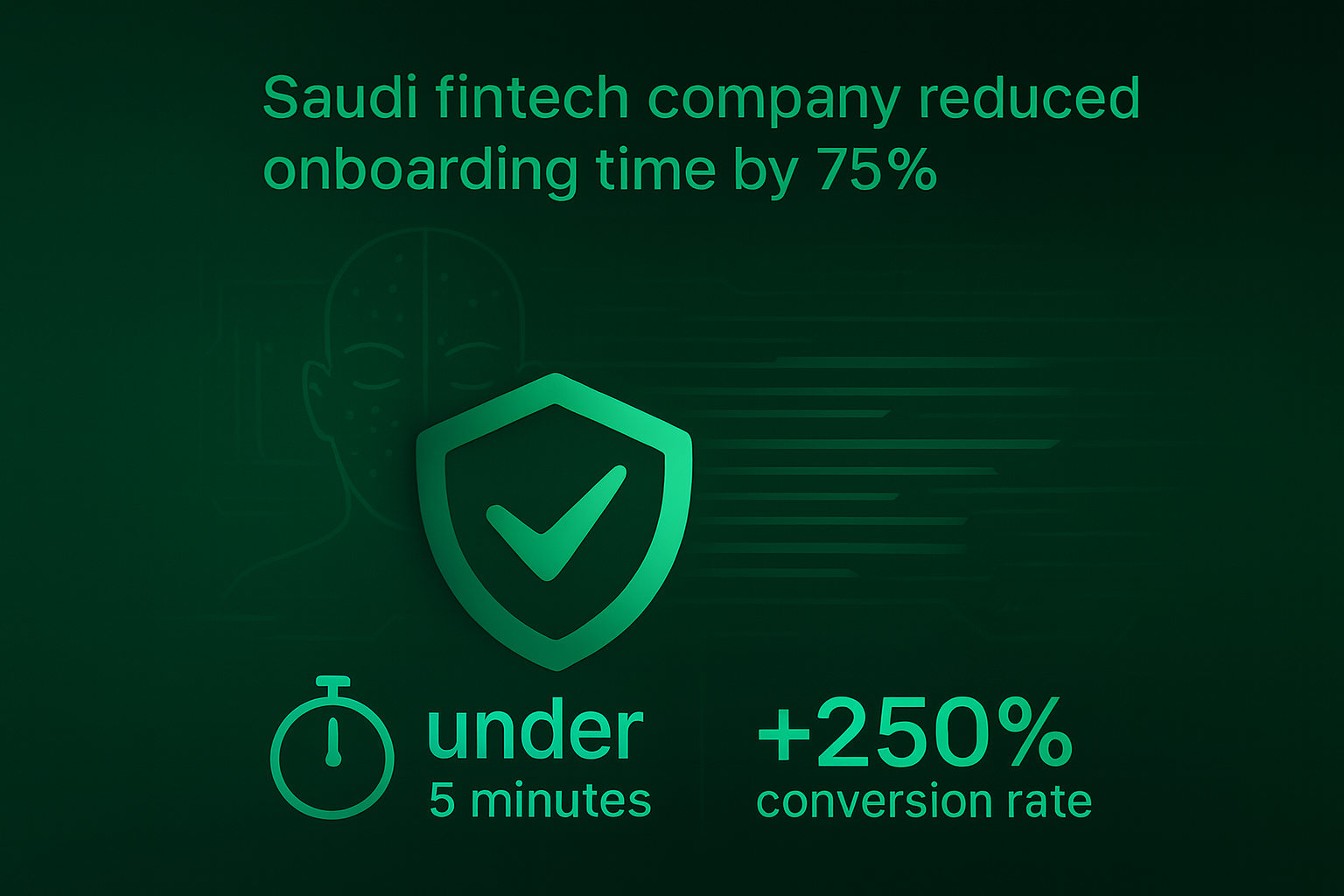

The results of the implementation exceeded all expectations. Customer onboarding time was reduced from an average of 3-5 business days to under 10 minutes for the majority of users. The completion rate for new registrations increased from 40% to 92%, representing a significant improvement in customer acquisition efficiency. Customer satisfaction scores for the onboarding process improved dramatically, with users particularly appreciating the speed and convenience of the new system.

From a business perspective, the improved onboarding process enabled the company to scale their customer acquisition efforts significantly. The reduced manual processing requirements allowed compliance teams to focus on higher-value activities, while the improved user experience contributed to increased customer lifetime value and reduced support costs. The company reported a 300% increase in new customer registrations within the first quarter following implementation.

Security metrics also showed substantial improvements. The intelligent authentication system detected and prevented several attempted fraud cases that might have been missed by traditional verification methods. The multi-factor approach and real-time risk assessment capabilities provided stronger protection against identity theft and account takeover attempts. Compliance audits confirmed that the new system exceeded regulatory requirements while providing enhanced security compared to previous methods.

The success of this implementation has broader implications for the Saudi fintech industry and digital transformation initiatives across the Kingdom. It demonstrates that innovative authentication technologies can simultaneously improve user experience, enhance security, and maintain regulatory compliance. The case study provides a blueprint for other financial services companies looking to modernize their customer onboarding processes while meeting the evolving expectations of Saudi consumers.

Looking forward, the company continues to refine and enhance their authentication capabilities. Plans include integration with additional biometric modalities, expansion of risk assessment algorithms, and exploration of emerging technologies like blockchain-based identity verification. The ongoing evolution of the authentication system reflects the company's commitment to maintaining their competitive advantage while providing the best possible experience for their customers.

At Authentica, we've worked with numerous fintech companies across the Middle East to implement similar intelligent authentication solutions. Our platform provides the flexibility and security features necessary to meet diverse regulatory requirements while delivering exceptional user experiences. The success stories from our clients demonstrate the transformative potential of modern authentication technology when properly implemented and integrated with existing business processes.

The future of customer onboarding in the financial services industry will be defined by companies that can successfully balance security, compliance, and user experience. This case study illustrates that with the right technology and implementation approach, it's possible to achieve significant improvements in all three areas simultaneously, creating value for businesses, customers, and regulatory authorities alike.